Get This Report about How Do I Get A Copy Of Bankruptcy Discharge Papers

Wiki Article

How Bankruptcy Discharge Paperwork can Save You Time, Stress, and Money.

Table of ContentsHow To Obtain Bankruptcy Discharge Letter for BeginnersExamine This Report on Copy Of Bankruptcy DischargeThe 7-Minute Rule for How To Get Copy Of Chapter 13 Discharge PapersSome Known Details About Copy Of Bankruptcy Discharge

Married people should collect this info for their partner no matter whether they are filing a joint petition, separate individual requests, and even so one spouse is submitting (how do i get a copy of bankruptcy discharge papers). In a situation where just one partner data, the earnings and also expenses of the non-filing spouse are needed to ensure that the court, the trustee and also creditors can examine the household's financial placement.Therefore, whether specific building is exempt and also may be kept by the borrower is commonly a concern of state regulation. The borrower needs to get in touch with an attorney to determine the exceptions readily available in the state where the borrower lives. Submitting an application under chapter 7 "immediately remains" (quits) a lot of collection actions against the debtor or the borrower's property (how do you get a copy of your bankruptcy discharge papers).

Submitting the petition does not remain particular kinds of activities detailed under 11 U.S.C. 362(b), and also the keep might be effective only for a short time in some situations. As long as the stay is in result, financial institutions typically might not start or proceed legal actions, wage garnishments, or also telephone calls requiring settlements.

trustee will report to the court whether the situation need to be assumed to be a misuse under the ways examination explained in 11 U. https://anotepad.com/note/read/nmy6f95w.S.C. 704(b). It is crucial for the debtor to accept the trustee and also to offer any monetary records or documents that the trustee requests. The Insolvency Code requires the trustee to ask the debtor concerns at the meeting of financial institutions to make certain that the borrower is aware of the possible repercussions of seeking a discharge in personal bankruptcy such as the result on credit report, the capacity to file a petition under a different chapter, the impact of receiving a discharge, as well as the result of reaffirming a financial obligation.

Not known Details About Obtaining Copy Of Bankruptcy Discharge Papers

701, 704. If all the debtor's assets are excluded or based on valid liens, the trustee will normally submit a "no possession" report with the court, and there will be no distribution to unsecured lenders. The majority of phase 7 situations involving individual borrowers are no property situations. If the case appears to be an "possession" case at the outset, unsafe lenders (7) need to file their insurance claims with the court within 90 days after the first day established for the conference of lenders.

A secured lender does not require to file an evidence of case in a phase 7 case to protect its safety interest or lien, there might be other reasons to file an insurance claim. A creditor in a phase 7 case who has a lien on the debtor's residential property need to consult a lawyer for guidance.

It try this website consists of all lawful or fair interests of the debtor in residential property since the beginning of the case, consisting of home possessed or held by an additional individual if the debtor has a rate of interest in the residential or commercial property. how do i get a copy of bankruptcy discharge papers. Typically talking, the borrower's creditors are paid from nonexempt building of the estate.

The 2-Minute Rule for How To Get Copy Of Chapter 13 Discharge Papers

The trustee achieves this by offering the borrower's residential property if it is complimentary and also clear of liens (as long as the residential property is not exempt) or if it is worth greater than any kind of protection interest or lien affixed to the property and also any kind of exception that the debtor holds in the property.In addition, if the debtor is a company, the insolvency court may license the trustee to run the business for a limited time period, if such procedure will benefit creditors as well as boost the liquidation of the estate. 11 U.S.C. 721. Area 726 of the Personal bankruptcy Code controls the circulation of the building of the estate.

The debtor is only paid if all various other classes of claims have actually been paid completely. As necessary, the debtor is not particularly curious about the trustee's personality of the estate assets, except relative to the settlement of those debts which for one reason or another are not dischargeable in the bankruptcy situation.

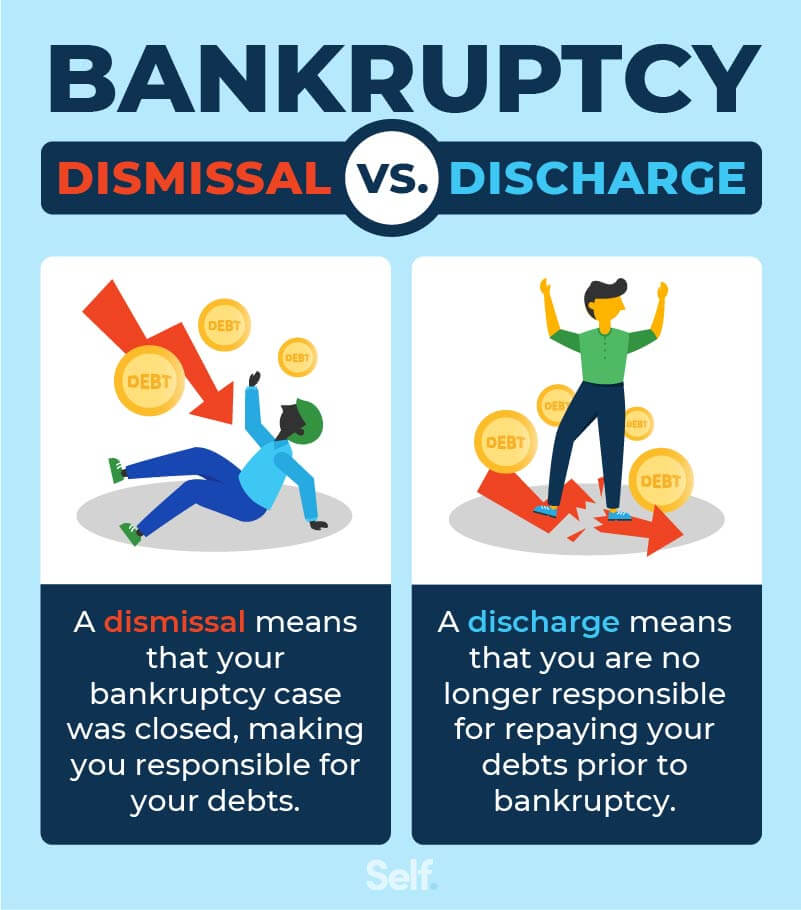

A discharge launches specific debtors from personal responsibility for most debts and also avoids the creditors owed those financial obligations from taking any type of collection actions versus the debtor. Due to the fact that a phase 7 discharge undergoes many exemptions, borrowers need to get in touch with competent lawful advise before filing to discuss the range of the discharge.

Copy Of Bankruptcy Discharge Fundamentals Explained

In return, the lender promises that it will not reclaim or reclaim the vehicle or various other property as long as the debtor remains to pay the debt. If the borrower determines to declare a financial obligation, she or he need to do so prior to the discharge is entered. The debtor must sign a created reaffirmation arrangement and also submit it with the court (https://www.bookmarkbid.com/author/b4nkruptcydc/).

524(c). The Personal bankruptcy Code needs that reaffirmation agreements consist of an extensive collection of disclosures explained in 11 U.S.C. 524(k). Amongst various other points, the disclosures should advise the debtor of the quantity of the debt being declared and just how it is calculated which reaffirmation indicates that the borrower's personal responsibility for that financial obligation will certainly not be released in the bankruptcy.

A specific gets a discharge for most of his or her debts in a chapter 7 personal bankruptcy instance. A lender may no longer initiate or proceed any lawful or various other activity versus the debtor to gather a discharged financial obligation.

Report this wiki page